I talked to developer Mick Duncan of Duncan Homes last week about what he’s seeing in the market right now, and I thought his observation was a great distillation of what’s going on.

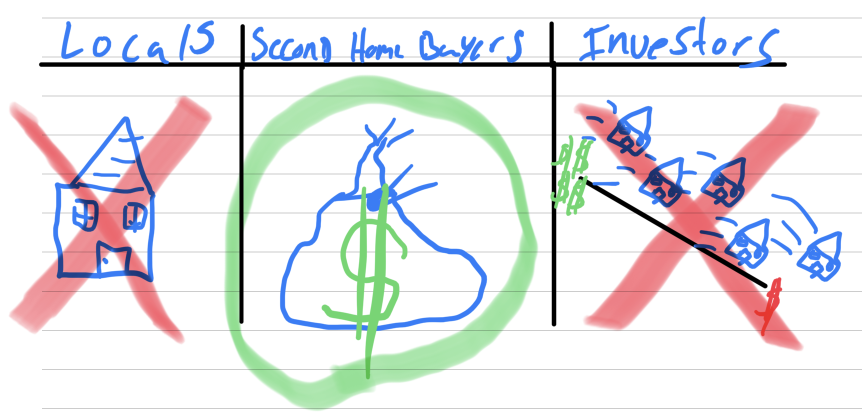

Mick says there are generally three types of buyers in Ocean City, and two of them are moving to the sidelines:

1) Locals, year-rounders, residents

Mostly single-family buyers, they are now largely priced out of the market. Four years ago, the median single-family home in Ocean City was less than $700k. Now it’s $1.5 million. Locals may have equity in their current home, but that doesn’t help when the new home is just as expensive– never mind a switch from a 4% mortgage to a 7% mortgage.

2) Second-home buyers

According to Duncan, they are still keeping the market propped up. Largely cash buyers (read: rich), prices and mortgage rates are less of a concern for them. Demand is still strong for Shore real estate, particularly in family-friendly Ocean City, and so they are still able to pay a premium to live here.

But, the hysteria of 2021 and 2022 is largely gone, according to Duncan. And coupled with the lack of local and investor (more on them in a minute) buying, second-home buyers are being more selective and patient, and thus the longer average days on market we’re seeing lately.

3) Investors

I’ll let Mick take this one:

“The investors are having a hard time making the numbers work. So, you know, an investor looks at it and says, okay, what can I buy it for? What’s my rent? What are my rentals? And then what are my carrying costs? And with prices up so high and rates so high, their mortgage payments or their carrying costs are probably almost double what they were a year or two ago, and rents have gone up, but not nearly enough to make the numbers work.”

Mick Duncan

Mick said his firm is more picky about properties they are buying right now. They try not to speculate on where the market will end up– rather they focus on how the math works now. He says carrying costs (costs to maintain a property before it’s sold) are up thanks to increased interest rates, but that’s a smaller piece of the pie. What’s worse is construction costs have doubled the last few years. Prices kept pace with costs while the market was hot, but now that things have cooled a bit, it makes it that much more risky to build a place. Mick says if his cost estimates are off by 10%, he may wind up making little or no profit at current prices.