June market data is in, and it’s… not great.

The hard numbers.

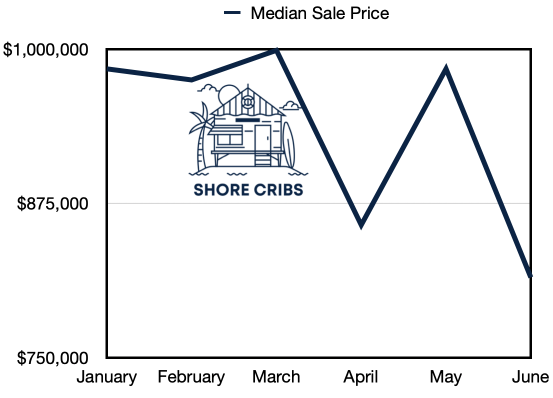

- Median Sale Price: $815,000 (-14% YoY, -21% from May)

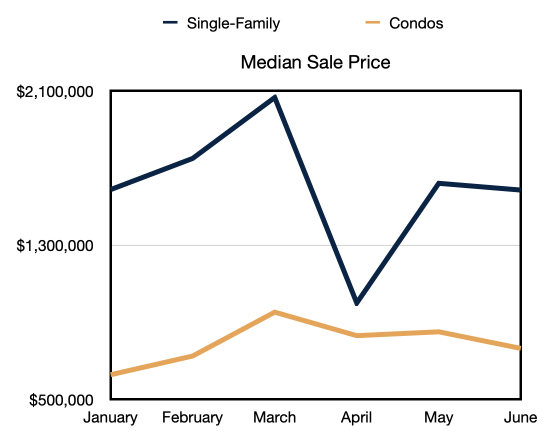

- Single-Family Median Sale Price: $1,585,000 (+5% YoY, -2% from May)

- Condo Median Sale Price: $764,000 (+2% YoY, -11% from May)

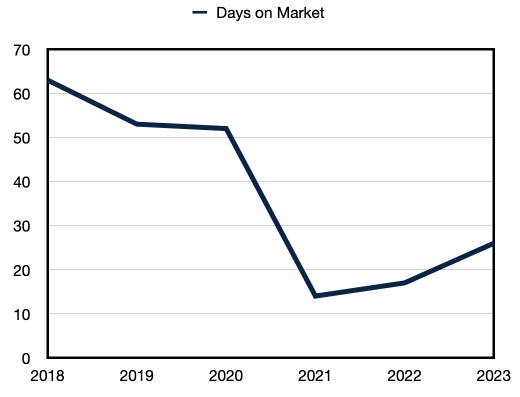

- Active Days on Market: 33 (+42% YoY, +12% from May)

- New Listings: 101 (-12% YoY, -4% from May)

- Sold: 63: (-5% YoY, -10% from May)

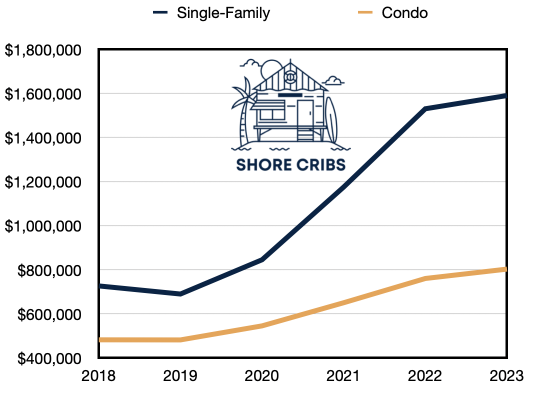

None of these numbers are good. Overall median sale price is way down year-over-year and month-over-month. Activity (listings, inventory, sales) are down across the board. But somehow single-family and condo median sale prices are up, however slightly, year-over-year.

How is that possible?

It’s because fewer single-family homes sold in June compared to last year.

In June of 2022, there were 23 single-family homes sold (34% of residential sales). This June there were 18 (28% of residential sales). That’s enough to skew the median quite a bit.

So you may soon see “Ocean City Home Prices are Down 21% Year Over Year!” headlines. They will be accurate, but also not tell the whole story.

Either way, we are no longer seeing dramatic year-over-year gains. Here’s the chart for the first six months of the year from 2018-2023:

And the monthly trajectory is negative:

Homes are staying on the market longer than the last two years, though still way shorter than 2018-2020:

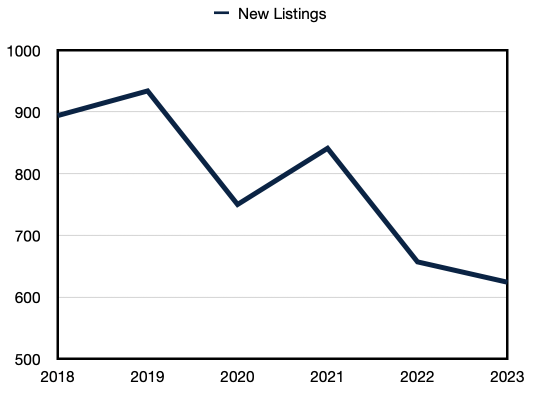

Prices are holding steady likely because of a baron wasteland of new listings (first six months of previous years):

Active inventory is around 225 (typically expected to be around 700-900).

As we discussed last month, the most likely reason for the lack of inventory, both nationally and locally, is higher interest rates keeping current home owners with 3%-4% rates from wanting to sell. The Jersey Shore has the added benefit of being a great second home market, so demand from cash-flush second-home buyers is still there. Locals and investors, however, are beginning to get priced out.